Section 179 of the IRS tax code allows businesses to deduct the full purchase price of a

VERSAPURE™ Sanitation Cabinet.

What is the Section 179 Deduction?

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Section 179 is one of the few government incentives available to small businesses, and has been included in many of the recent Stimulus Acts and Congressional Tax Bills. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits.

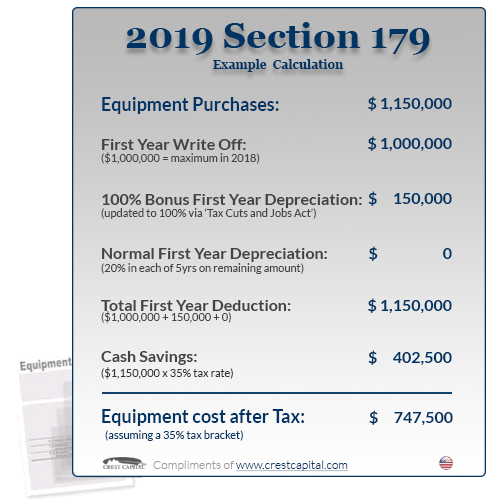

Section 179 Calculator

Are you considering whether or not to purchase or lease equipment in the current tax year? This Section 179 Deduction Calculator for 2021 may very well help in your decision, as Section 179 will save your company a lot of money (the deduction is at a robust $1,050,000, and will stay there for the entirety of 2021.)

How much money can Section 179 save you in 2021?

The Section 179 Deduction has a real impact on your equipment costs. Here’s an easy to use calculator that will help you estimate your tax savings. Simply enter in the purchase price of your equipment and/or software, and let the calculator take care of the rest.

Please note that this Section 179 Calculator fully reflects the current Section 179 limits and any and all amendments / bonus depreciation.

Grants & Loans

Paycheck Protection Program

An SBA loan that helps businesses keep their workforce employed during the Coronavirus (COVID-19) crisis.

Economic Injury Disaster Loans

This loan provides economic relief to small businesses and non-profit organizations that are currently experiencing a temporary loss of revenue.

CARES Act Provider Relief Fund

The Provider Relief Funds supports American families, workers, and the heroic healthcare providers in the battle against the COVID-19 outbreak.

CARES Act for State, Local, and Tribal Governments

This CARES Act provides payments to State, Local, and Tribal governments navigating the impact of the COVID-19 outbreak.